https://finanzasdomesticas.com/el-impuesto-digital

https://finanzasdomesticas.com/el-impuesto-digital , or digital tax, is a new rule that many countries are using to tax online sales and services. If you sell digital goods or services, you might need to pay this tax based on where your customers live. This can be tricky because each country has its own rules for el impuesto digital.

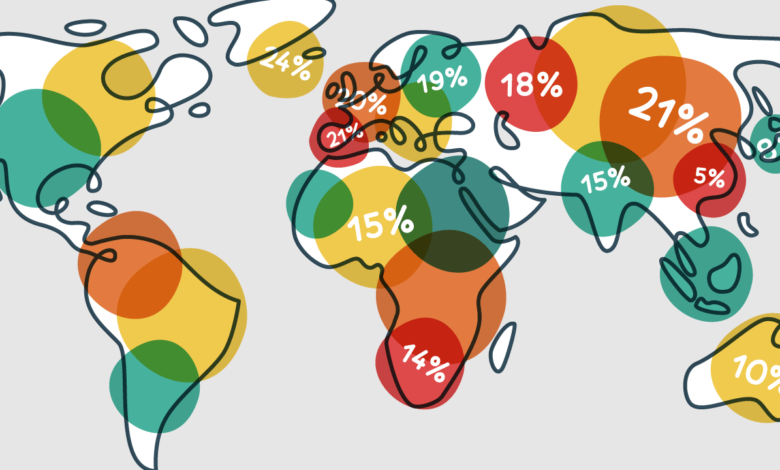

Around the world, more places are starting to use el impuesto digital to make sure they get their fair share of taxes from online businesses. This means you need to keep track of where your customers are and make sure you’re charging the right tax for each place. In this blog post, we will look at how el impuesto digital is changing the way businesses work and what you need to do to stay compliant

https://finanzasdomesticas.com/el-impuesto-digital:What is El Impuesto Digital

El impuesto digital is a type of tax many countries use to charge for online sales and services. If you sell digital products or services, you may need to pay this tax based on where your customers live. This helps governments collect money from online businesses, even if they are based in another country.

El impuesto digital ensures that all businesses contribute fairly, regardless of where they are from. The tax rates can vary widely between countries. Some places may have high rates, while others have lower ones. It’s important to understand these rules to comply with the laws and avoid fines.

Businesses need to track where their customers are and apply the correct tax rate for each location. If you sell to people in multiple countries, you must manage these rules carefully. This can be complicated, but it’s essential for staying legal and avoiding issues https://finanzasdomesticas.com/el-impuesto-digital.

El impuesto digital is becoming more common as more countries seek to ensure they are getting their fair share of taxes from online transactions. Following these rules helps businesses contribute to the local economies of the countries they serve.

How El Impuesto Digital Affects Your Online Business

El impuesto digital can significantly impact your online business. First, you need to adjust your pricing to include the tax for different regions. This means the price for customers may change depending on their location, which can be confusing for both you and them https://finanzasdomesticas.com/el-impuesto-digital.

Another effect of el impuesto digital is the increased paperwork and reporting. You have to keep track of sales from different regions and report them accurately. This added responsibility takes extra time and resources, so planning ahead is crucial.

Managing el impuesto digital also means ensuring your business systems can handle these changes. You might need to update your software or get new tools to automatically calculate and apply the correct tax rates. This helps you stay compliant with various tax laws.

Finally, understanding and applying el impuesto digital correctly helps you avoid penalties and fines. Incorrectly charging or reporting taxes can lead to legal trouble. Staying informed and maintaining accurate records will keep your business running smoothly https://finanzasdomesticas.com/el-impuesto-digital.

https://finanzasdomesticas.com/el-impuesto-digital:Countries with El Impuesto Digital Laws

Many countries have introduced el impuesto digital to tax online sales. For instance, the European Union has specific rules on how this tax should be applied. If you sell digital products to customers in Europe, you must follow these regulations and charge the appropriate tax.

In countries like Australia and Canada, el impuesto digital laws can differ. Australia has a set tax rate for digital services, while Canada has various rates for different provinces. Knowing these differences is important for international sellers.

India and Japan have also implemented their own versions of el impuesto digital. India started its tax in 2016, and Japan introduced its rules in 2015. Each country has unique regulations, so businesses need to stay updated on these changes.

As more countries adopt el impuesto digital, businesses must prepare to handle these diverse requirements. Understanding the specific rules for each country where you have customers helps you apply the correct tax and stay compliant https://finanzasdomesticas.com/el-impuesto-digital.

How to Manage El Impuesto Digital for Your Sales

Managing el impuesto digital for your sales involves careful planning. Start by setting up a system to track your customers’ locations. This helps you apply the correct tax rate for each region and keep accurate records for reporting.

Next, update your online store or accounting software to handle el impuesto digital. Many tools can automatically calculate and apply the right tax rates for different areas. This makes managing your tax responsibilities easier and more accurate.

It’s also important to stay informed about changes in tax laws. El impuesto digital rules can evolve, so keeping up-to-date helps you avoid mistakes. Regularly review and adjust your tax practices to keep your business compliant https://finanzasdomesticas.com/el-impuesto-digital.

Finally, consider consulting a tax professional to ensure you meet all requirements. A tax expert can help you navigate the complexities of el impuesto digital and avoid potential issues.

https://finanzasdomesticas.com/el-impuesto-digital:Understanding El Impuesto Digital and Its Purpose

El impuesto digital is a type of tax applied to digital goods and services. This includes things like apps, e-books, and online subscriptions. The purpose of el impuesto digital is to ensure that online businesses pay taxes in the countries where their customers are located. This helps governments collect revenue from businesses that operate across borders.

The idea behind el impuesto digital is to address the challenges that arise from selling products and services online. As more people shop online, governments want to make sure they can still collect taxes fairly. This tax helps level the playing field between local and international businesses by making sure everyone pays their share.

Different countries have different rules for el impuesto digital. Some might have a high tax rate, while others have a lower rate. These rules are important because they can affect how much you charge your customers and how much tax you need to pay. Understanding these rules is key to managing your business properly.

By applying el impuesto digital correctly, you help support the economy of the country where your customers live. This tax contributes to public services and infrastructure, ensuring that everyone benefits from the digital economy. Being informed about these taxes helps you stay compliant and avoid any legal issues https://finanzasdomesticas.com/el-impuesto-digital.

How to Apply El Impuesto Digital Correctly

Applying el impuesto digital correctly can be a bit complicated, but it’s essential for running an online business. First, you need to determine the tax rate for each region where you have customers. This means researching the tax rules for every country you sell to and applying the right rate https://finanzasdomesticas.com/el-impuesto-digital.

Next, update your online store or accounting system to handle these different tax rates. Many software tools can help with this by automatically calculating and applying the correct tax. This can save you time and reduce errors in your tax calculations.

It’s also important to keep accurate records of your sales and taxes collected. This information is needed for reporting and filing taxes. Keeping detailed records ensures that you can easily provide information if needed and helps you stay organized.

Finally, make sure you stay updated on any changes to tax laws. El impuesto digital rules can change, so regularly check for updates and adjust your practices as needed. This helps you stay compliant and avoid any penalties for incorrect tax filings https://finanzasdomesticas.com/el-impuesto-digital.

https://finanzasdomesticas.com/el-impuesto-digital:Common Mistakes with El Impuesto Digital and How to Avoid Them

Many businesses make mistakes when dealing with el impuesto digital, which can lead to problems. One common mistake is not applying the correct tax rate. Each country has its own rate, and using the wrong one can result in overcharging or undercharging customers.

Another mistake is not keeping proper records. Accurate records are crucial for reporting taxes and ensuring compliance. Without them, you might face difficulties during tax audits or when trying to prove your tax filings are correct.

Failing to update your systems to handle el impuesto digital can also cause issues. If your online store or accounting software doesn’t account for different tax rates, you might make mistakes in your calculations. Regularly updating and checking your systems can help prevent this.

To avoid these mistakes, it’s important to stay informed and organized. Regularly review your tax practices, keep detailed records, and use reliable tools to manage your taxes. Consulting with a tax professional can also help ensure that you are handling el impuesto digital correctly https://finanzasdomesticas.com/el-impuesto-digital.

https://finanzasdomesticas.com/el-impuesto-digital:El Impuesto Digital and International Sales

When selling internationally, understanding el impuesto digital is crucial. Each country has its own rules for how this tax should be applied to digital products. For example, the tax rates and regulations can vary greatly from one country to another https://finanzasdomesticas.com/el-impuesto-digital.

To manage international sales effectively, you need to be aware of the tax rules in each country where you have customers. This means researching and applying the correct tax rates based on the customer’s location. Keeping up with these rules helps you stay compliant and avoid any legal issues.

Using software tools that handle international taxes can make this process easier. Many tools can automatically calculate and apply the right tax rates based on the customer’s location. This helps simplify the management of el impuesto digital for international sales.

Additionally, staying updated on changes in international tax laws is important. As more countries adopt el impuesto digital, regulations may change. Regularly reviewing and updating your practices ensures that you remain compliant with all tax requirements https://finanzasdomesticas.com/el-impuesto-digital.

How El Impuesto Digital Impacts Different Types of Businesses

El impuesto digital can impact various types of businesses in different ways. For example, businesses that sell digital products like e-books and software must apply this tax based on where their customers are located. This requires understanding and applying different tax rates for each region.

Businesses that offer online services, such as streaming or online courses, are also affected by el impuesto digital. They need to ensure that they apply the correct tax rate for each customer’s location. This can require updating pricing and accounting practices to reflect the tax rules.

For international businesses, managing el impuesto digital can be more complex. They must navigate different tax regulations for each country where they have customers. This often involves using specialized software or consulting with tax experts to handle these requirements.

Overall, understanding how el impuesto digital affects your specific business type helps you manage taxes effectively. By applying the correct tax rates and staying informed about regulations, you ensure compliance and avoid potential issues https://finanzasdomesticas.com/el-impuesto-digital.

https://finanzasdomesticas.com/el-impuesto-digital:Navigating El Impuesto Digital: A Guide for Small Businesses

For small businesses, handling el impuesto digital can be challenging but manageable. One key aspect is understanding which countries require this tax and how it applies to your products or services. Many small businesses may sell digital goods to customers worldwide, so knowing the specific tax rules for each country is crucial.

Start by researching the tax regulations in the countries where you do business. This involves figuring out the correct tax rates and knowing how to apply them to your sales. Some countries may have specific thresholds or conditions, so it’s important to get this right to avoid any issues.

Setting up your online sales platform to handle el impuesto digital is also essential. Many e-commerce platforms and accounting software can be configured to automatically apply the correct tax rates based on the customer’s location. This automation helps ensure that you are collecting the right amount of tax without having to do complex calculations manually.

Additionally, staying organized with your records is vital. Keep detailed records of all sales and the taxes collected. This will make it easier to file your taxes and provide proof if needed. Regularly review your records and tax practices to ensure everything is accurate and up-to-date.

https://finanzasdomesticas.com/el-impuesto-digital:The Benefits of Compliance with El Impuesto Digital

Complying with el impuesto digital brings several benefits to businesses. First and foremost, it helps you avoid legal issues and penalties. By following the rules and correctly applying the tax, you ensure that your business stays in good standing with tax authorities.

Another benefit is that it promotes fairness in the digital marketplace. When all businesses comply with tax regulations, it helps create a level playing field. This is especially important for small businesses that may compete with larger companies operating internationally https://finanzasdomesticas.com/el-impuesto-digital.

Complying with el impuesto digital also builds trust with your customers. When customers see that you are transparent and following legal requirements, they are more likely to view your business positively. This can lead to stronger customer relationships and increased loyalty.

Additionally, understanding and applying el impuesto digital correctly helps you manage your business finances more effectively. Accurate tax calculations and proper record-keeping contribute to better financial planning and management. https://finanzasdomesticas.com/el-impuesto-digital.

https://finanzasdomesticas.com/el-impuesto-digital:The Future of El Impuesto Digital: Trends and Predictions

The future of el impuesto digital is evolving rapidly as more countries implement and adjust their tax policies. One trend is the increasing adoption of digital taxes worldwide. As more businesses operate online, governments are likely to introduce or revise their digital tax laws to capture revenue from this growing sector.

Another trend is the use of technology to simplify tax compliance. Advanced software solutions and automated systems are becoming more common, helping businesses manage el impuesto digital more efficiently. These tools can handle complex tax calculations and updates, reducing the burden on businesses.

There is also a growing focus on international cooperation regarding digital taxes. Countries are working together to create more consistent and harmonized tax regulations. This cooperation aims to address challenges related to cross-border sales and ensure fair tax practices globally https://finanzasdomesticas.com/el-impuesto-digital.

Looking ahead, businesses should stay informed about changes in digital tax laws and be prepared to adapt. Keeping up with trends and advancements in tax technology will help you manage el impuesto digital effectively and ensure compliance as regulations continue to evolve.

Conclusion

Navigating el impuesto digital can seem tricky, but it’s manageable with the right approach. By understanding the tax rules for each country where you sell digital goods, you can ensure you’re following the law and avoiding problems. Using technology like tax software and e-commerce tools can make handling these taxes much easier.

In the end, staying organized and keeping up with changes in tax regulations will help your business run smoothly. With a little effort and the right tools, you can handle el impuesto digital confidently and focus on what you do best—serving your customers and growing your business https://finanzasdomesticas.com/el-impuesto-digital.